A look at the charitable sector in Canada

People choose to volunteer for a variety of reasons. For some, it offers the chance to give something back to their local community. For others, it provides an opportunity to develop new skills.

During times of uncertainty and challenges, many of us feel the need to lend a hand. In fact, volunteers are needed more than ever before when times get tough.

Older Canadians make a significant contribution to our society through volunteering. However, various charities and media have reported that thousands of seniors across Canada who would normally be volunteering have stayed at home to protect their health.

If volunteering is already part of your everyday life—we applaud you! For the rest of us thinking about lending a hand to others, we’re hoping the following pages will help you to find new and interesting ways to give your talents, energy and time in person or virtually.

And know that while volunteering is ultimately about giving back to others, in the short or long-term, you’ll have the chance to develop new skills, new relationships outside of your current social circle and even new opportunities for personal growth.

Contributions that count

Most Canadians have likely engaged with a charity or non-profit at some point in their lives and many engage with them daily. Whether it’s a small community service organization, hospital, university or national charity that you’re willing to help with, it’s important to dig a little deeper and try to understand how important this sector is to both our well-being and our country’s economy.

First off, before you start giving back be sure you know a little bit about the organization and its structure. There is, for instance, a difference between a charity and a non-profit. All charities are run as non-profits but not all non-profits are charities.

Organizations wishing to be recognized as registered charities must apply to Canada Revenue Agency (CRA), which will look at their purposes, determine if they meet the requirements to be granted a charitable registration and monitor them on an ongoing basis.

It’s the law

According to CRA, all charities are officially required to:

• Engage only in allowable activities. A registered charity is allowed to carry out its charitable purposes both inside and outside Canada in only two ways: by carrying on its own charitable activities and by gifting to qualified donees. A registered charity must maintain direction and control over its activities (whether carried out by the charity or by an agent or contractor on its behalf) and must not engage in activities that directly or indirectly support or oppose a political party or candidate for public office or unrelated business activities.

• Keep adequate books and records. A registered charity must keep adequate books and records for the prescribed time period at an address in Canada that is on file with the Canada Revenue Agency.

• Issue complete and accurate donation receipts. A registered charity may only issue official receipts for donations that legally qualify as gifts. An official receipt must contain all the information specified in Section 3501 of the Income Tax Regulation.

• Meet annual spending requirements (disbursement quota). A registered charity must spend the minimum amount calculated for its disbursement quota each year on its own charitable activities, or on gifts to qualified donees (for example, other registered charities).

• File an annual T3010 information return. A registered charity must file an annual T3010 information return (together with financial statements and required attachments) no later than six months after the end of the charity’s fiscal period.

• Maintain the charity’s status as a legal entity. A registered charity that is constituted federally, provincially or territorially must meet other specific requirements (in addition to the requirements of CRA) in order to maintain its status as a legal entity. This may include annual filing and/or annual fees. A registered charity should check with the relevant authorities to verify these additional requirements.

• Inform the Charities Directorate of any changes to the charity’s mode of operation or legal structure. A registered charity should get confirmation from the Charities Directorate (the Directorate) before changing its stated objectives and/or activities to make sure they qualify as charitable. A registered charity should inform the Directorate if it changes its name, telephone number, address, contact person or governing documents (constitution, letters patent, etc.) and must obtain prior approval from the Directorate before changing its fiscal year-end.

As part of its ongoing efforts to make sure charities meet the requirements of registration, the CRA uses a variety of compliance activities. Historically, the CRA has audited approximately 800 to 900 charities per year, representing about 1 per cent of registered charities.

Many of the same guidelines apply for those running not-for-profits as well. However, the main difference is that a registered charity can issue official receipts for donations for income tax deduction purposes. Non-profits do not register with the CRA, so they are not able to issue official donation receipts for income tax purposes. Therefore, as a donor, you cannot receive any tax credits.

An integral part of our economy

The charitable and non-profit sector’s contribution is significant when looked at as a whole—greater than the GDP of the retail trade industry and close to the value of the mining, oil and gas extraction industry. The “core non-profit sector” is the common way to refer to charitable and non-profit organizations that are not hospitals and universities. Their revenues account for about 2.4 per cent of Canada’s GDP. That’s more than three times that of the motor vehicle industry.

Many members of the public believe that charities and non-profits are funded by the government for the most part which is not the case. Each of them has various sources of income including: earned income from the sale of products and services (a whopping 45.1 per cent of the sector’s income), individual, family or corporate donations as well as grants from private foundations and the government.

Some organizations receive no funding from any government department. Hospitals, universities, and colleges are the exception to this rule. Almost 75 per cent of their funding comes from governmental sources with 72 per cent of that being from a provincial government. In number, these institutions only represent 1 per cent of the total number of organizations, but they represent around 66 per cent of the total revenues of the entire sector.

Funding sources for charities and non-profits

The Satellite Account of Non-profit Institutions and Volunteering published by Statistics Canada showed a breakdown of the core non-profit sector funding:

• sales of goods and services account for 45.6 per cent of total income

• government funding at 20.9 per cent

• membership fees 17.1 per cent

• donations from households 11.2 per cent

• investment income 3.6 per cent

Simply essential

Charities play a very valuable role in communities from coast to coast, providing expertise and support to every aspect of our daily lives in healthcare, education, alleviation of poverty, combatting food insecurity and fighting climate change, to mention a few.

Just as importantly, charities contribute to Canada’s public policy process. Some of the finest outcomes have been achieved when charities and governments work together, such as in the drunk driving legislation and smoke-free workplaces initiatives.

Where to volunteer

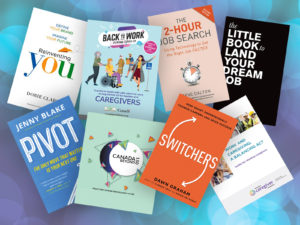

There are a number of ways to find the best place to give volunteer hours and some great resources. A few of our favourites include Volunteer Canada, Charity Village, United Way and Canadian Red Cross. For a full listing see page 12. CanadaHelps is a donation and fundraising portal that provides a listing of all charities in Canada, presents their mission and program information and offers an easy way for Canadians to make donations to their favourite charity.

Did you know?

Imagine Canada’s Research Notes shows that almost half of the population aged 15 and over (12.5 million people) volunteer and engage with charities on a regular basis, contributing 2.1 billion volunteer hours which translates into 1.1 million full-time jobs.